- WAYA Media

- Posts

- Emirates NBD’s Billion-Dollar Bank Grab 💰 - WAYA's Weekly Roundup

Emirates NBD’s Billion-Dollar Bank Grab 💰 - WAYA's Weekly Roundup

What’s good, Wayans?

Welcome to the WAYA Weekly Roundup! Your shortcut to staying in the loop on the region’s biggest business and startup stories. We sift through the noise, pick out the need-to-know stuff, and serve it up fresh-so you can stay informed without the info overload.

This week, we’ve got billion-dollar deals, bold acquisitions, and big economic shifts. Emirates NBD targets Banque du Caire, Saudi’s Scopely nabs Niantic’s gaming division, and Careem Pay expands remittances. Plus, Egypt’s inflation takes a dip, the IMF approves fresh funds, and we’re tracking the hottest IPOs and VC rounds.

Let’s dive in. 🚀

Spotlight

Egypt’s Inflation Drops, IMF Cuts a Check, and Fuel Subsidies Face the Clock

Well, that escalated—or rather, de-escalated—quickly.

Egypt’s annual inflation rate took a nosedive to 12.5% in February, down from 23.2% in January, marking its lowest level in three years.

🔎 What’s behind the drop? CAPMAS credits slower food price increases, especially for veggies, tea, and cocoa. Analysts also point to a base effect—since inflation hit a brutal 38% peak in September 2023, today’s numbers look like a sharp cooldown.

⛽️ Fuel subsidies on the chopping block - The IMF’s Dr. Mohamed Maait confirmed that Egypt will fully lift fuel subsidies by December 2025. While this is meant to streamline energy pricing and trim budget deficits, it also raises concerns for low-income households that rely on those subsidies to keep fuel affordable.

💰️ IMF opens the vault - The fund just approved a $1.2 billion loan tranche as part of its $8 billion extended support program, signaling confidence in Egypt’s economic reforms. With inflation in check and interest rates stable since March 2024, the country seems to be steering towards fiscal stability—but the road ahead isn’t exactly pothole-free.

👉 Dive deeper here.

Stories That Matter

Emirates NBD Moves in on Banque du Caire with $1B+ Deal

Big moves in the banking world: Emirates NBD just got the go-ahead to dig into the books of Banque du Caire as it eyes a $1B+ acquisition.

📊 Change of plans - Egypt has been gearing up to take the bank public but decided to go for a direct sale instead.

🏦 First dibs - A Kuwaiti institution also threw its hat in the ring, but Emirates NBD got priority access.

🚧 Regulatory roadblocks? - The deal could see Banque du Caire offload its Sinai assets due to foreign ownership restrictions.

If the deal goes through, it would mark a big expansion play for Emirates NBD in North Africa. 👉 Dive deeper here.

Careem Pay Rolls Out Remittances to Egypt

Careem isn’t just about rides and deliveries—it’s also in fintech. UAE residents can now send money directly to Egyptian bank accounts, using Careem Pay, which promises fast transfers and competitive rates.

🌍️ Who else is in? The service already covers India, Pakistan, the UK, Europe, and the Philippines, expanding its reach across key remittance corridors.

💸 Big money flow - UAE-to-Egypt remittances hit a whopping $10B annually, cementing Egypt as one of the top destinations for money transfers from the UAE.

A convenient option for those looking to send funds back home, Careem Pay continues to broaden Careem’s financial services beyond ride-hailing.

Pokémon Go’s New Game Master? Saudi’s Scopely Buys Niantic’s Gaming Division

Saudi Arabia just hit another gaming power-up—Scopely, backed by the Public Investment Fund (PIF), is acquiring Niantic’s gaming division for $3.5B, marking another bold move in the Kingdom’s push to dominate the industry.

🔄 Niantic’s next move? After struggling to follow up on Pokémon Go’s success, the company is spinning off its geospatial AI business into a new entity, Niantic Spatial, with $250M in fresh funding.

🏆 Gaming’s next big hub? Saudi Arabia isn’t slowing down—it’s already committed $38B to gaming investments, with Scopely, Savvy Games, and other major deals leading the charge.

💰️ The Deal Sheet

Your weekly roundup of the biggest IPOs, startup funding rounds, and finance deals—who’s raising, how much, and what they’re planning next.

IPOs

➡️ Micropolis, a robotics company specializing in autonomous mobile robots, raised funds through an NYSE IPO and will use them for R&D, scaling production, and enhancing AI-driven automation in logistics and urban services. 👉️ Dive deeper here.

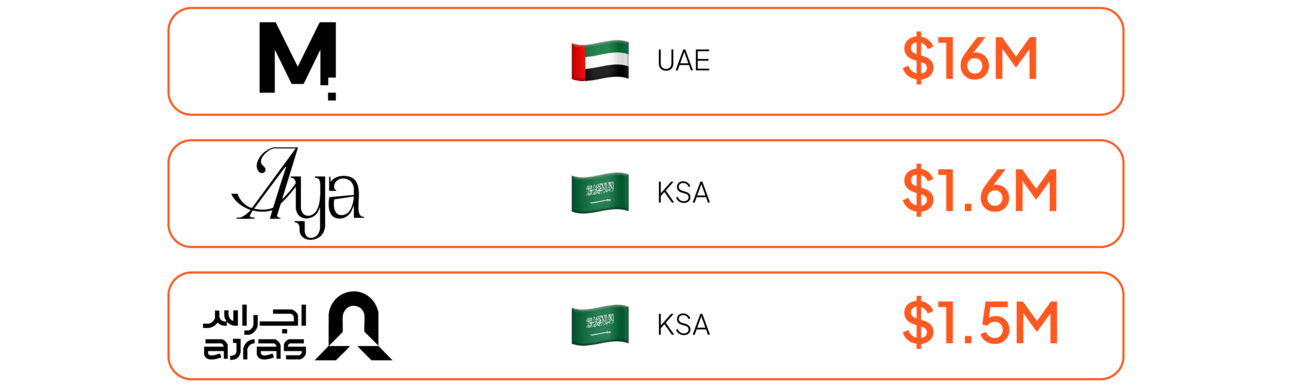

Startup & VC Funding

➡️ Aya, an e-commerce platform focused on modest fashion, secured funding from Khwarizmi Ventures and other investors to expand its product range, refine trend prediction, and empower local manufacturers. 👉️ Dive deeper here.

➡️ Ajras, a proptech startup providing “Rent Now, Pay Later” solutions, secured backing from Veda Holding to enhance its platform, streamline transactions, and scale its financing solutions for commercial and industrial rentals. 👉️ Dive deeper here.

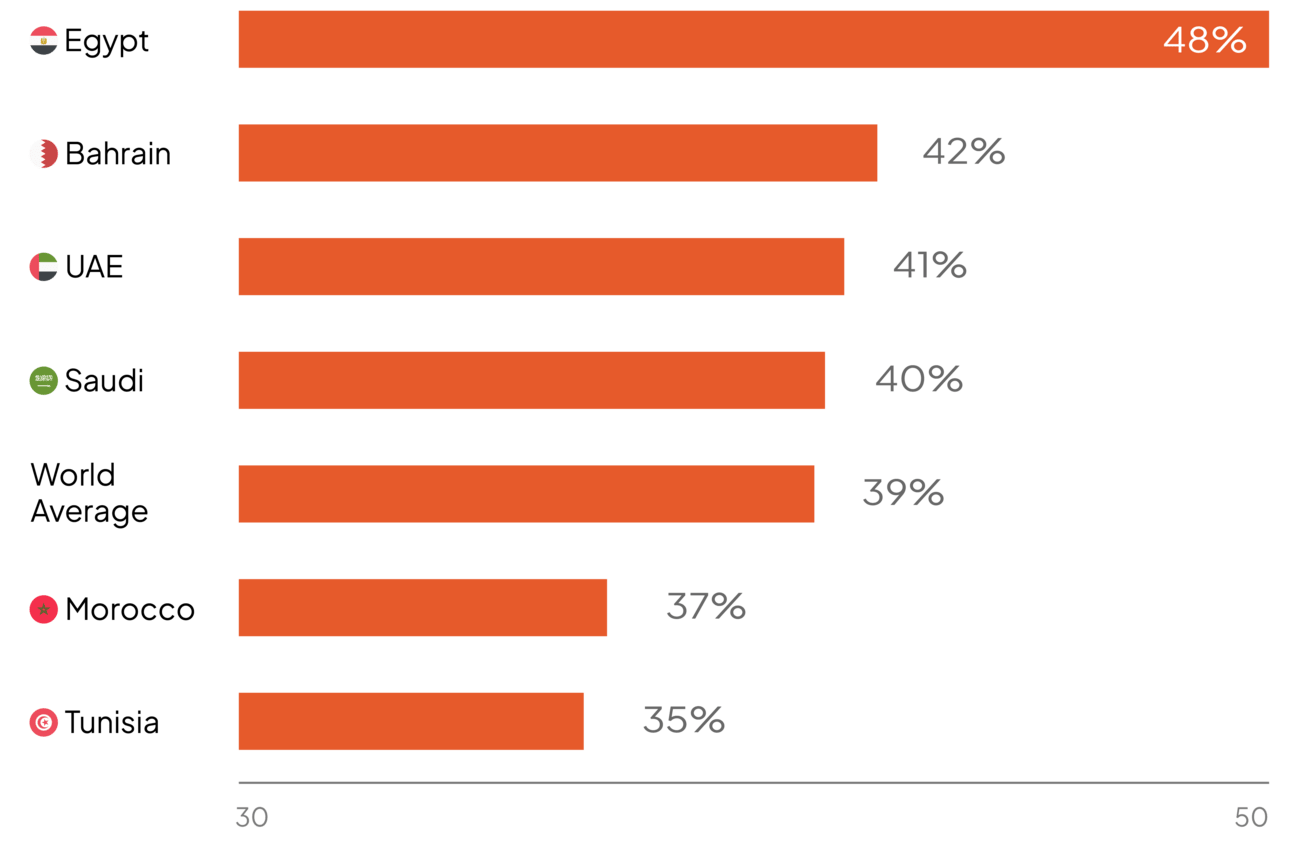

📊 Datapoint of the Week

Share of workers’ core skills that will change by 20230

Source: Future of Jobs Report, WEF

🤖 AI is Reshaping Jobs - The World Economic Forum’s Future of Jobs Report 2025 is in, and spoiler: AI and automation aren’t just replacing jobs—they’re reshaping them. The report, based on 1,000+ employers across 55 economies, predicts that 22% of jobs will see major disruption by 2030—but on the bright side, AI is also set to create 78 million net new roles.

📍 Where’s the biggest shake-up? Egypt tops the list for skill disruption, with other MENA countries not far behind.

As machines take on more tasks, AI and tech skills are becoming essential for staying ahead in the job market. Time to update that LinkedIn profile.

🌎 Global Eye

World news that affects us!

🤖 AI Without a Leash - China has unveiled Manus, an AI agent that operates fully independently, executing complex tasks without human input.

🧠 Thinking for Itself - Unlike chatbots that require prompts, Manus proactively analyzes, plans, and acts—whether it’s researching apartments or building websites from scratch.

⚡️ Game Changer or Threat? - With the ability to manage multi-step workflows and delegate to specialized AI agents, Manus signals a leap toward autonomous AI—but also raises concerns over job displacement and accountability.

👉️ See how it works here.

🌶️ Startup Sizzle 🌶️ is a series of bite-sized interviews hosted by our very own Salma El Maghraby with the region's most promising founders, bringing you the inside scoop on the next big thing!

In this week’s Startup Sizzle, we chat with Amer Baroudi, CEO of nsave, on how their fintech solution boosts financial inclusion in the developing world, helping people protect and grow their savings.

👉 Watch the episode here.

The Net Zero Myth: Carbon Markets Explained

🌍️ At COP29, world leaders doubled down on carbon markets—one of the most debated tools in the fight against climate change. But are they a real solution or just a way to keep polluting? 💨 Carbon markets let countries and companies buy and sell the right to emit CO2. Those that cut emissions below their cap can sell “carbon credits” to others that exceed theirs, creating a financial incentive to go green. 📈 The voluntary carbon market in MENA is expanding, offering new climate finance opportunities. But critics argue these markets allow major polluters to delay real change while communities most affected by climate change continue to suffer. 👉 Dive deeper here. |

🏄️ Surfing the Web

The best things we stumbled upon on the internet this week.

🇶🇦 The Qatar Perspective - Tucker Carlson sits down with Qatar’s Prime Minister to discuss cultural imperialism, global hypocrisy, and what critics of the country get wrong. 👉️ Watch here.

🚗 Egypt’s Auto Market Hits a Roadblock - Egypt’s car market is slamming into policy roadblocks, with new government restrictions sidelining independent importers and giving major dealerships full control again. A decision to release thousands of cars stuck in customers came with conditions so tight they haven’t moved an inch. With soaring prices, fewer choices, and growing frustration, the industry is looking more like the pre-2006 monopoly days. 👉️ Dive deeper here.

🚢 China’s Big Play for African Ports - Chinese firms are now involved in over a quarter of Africa’s ports, building, financing, and operating key trade hubs across the continent. While this investment boosts infrastructure, it also raises big questions about sovereignty, security, and military influence. Some ports could be repurposed for Chinese naval expansion, mirroring China’s Djibouti base. As China strengthens its foothold, Africa faces a balancing act—economic growth vs. geopolitical risks. 👉️ Dive deeper here.

🍎 Apple’s AI Rollercoaster - One moment, Apple is hyping up its AI-powered Siri, the next, it’s walking back key features. A recent Stratechery deep dive explores why Apple’s AI strategy feels both promising and problematic—with delays, security risks, and a platform play that could reshape its future. 👉️ Dive deeper here.

SURVEY - How do you feel about AI’s impact on jobs?As we saw in this week’s 'Datapoint of the Week', AI is transforming the workforce. While new roles will emerge, many traditional jobs could be at risk. We want to hear from you! Vote now. |

🤝 About this newsletter

We are writing this newsletter to break down the biggest stories shaping business, startups, and the future of the Arab world. Whether it’s market moves, funding rounds, policy shifts, or the next unicorn in the making—we connect the dots so you don’t have to.

More than just news, we bring you insights on how trends, entrepreneurs, and investors are shaping the region’s future. Expect this in your inbox every week—quick, sharp, and packed with what you need to know.

If you have any feedback, ideas, or topics we should cover, don’t hesitate to reach out to us. You can hit reply to this email or find us on LinkedIn. We actually read our messages.

The WAYA Team